Ethereum Layer 2 in 2026: Why Rollups Finally Won

The Ethereum network had a problem. In late 2024, during peak DeFi activity, simple token transfers cost $50 or more. Complex DeFi transactions ran into hundreds of dollars. Users waited minutes for confirmations during high demand periods. The network that promised to decentralize finance was pricing out everyone except whales.

Then the Dencun upgrade happened in March 2024, and everything changed.

EIP-4844 introduced blob transactions, cutting L2 fees by 90-95%. What had cost dollars became fractions of a cent. The change wasn’t just incremental—it was existential. Suddenly, Ethereum could actually serve the millions of users it had always promised to.

By 2026, rollups aren’t just an optimization. They’re the default execution layer for Ethereum.

The Numbers Don’t Lie

Let’s ground this in specifics. Today’s major rollups—Arbitrum, Optimism, Base, zkSync, and Starknet—routinely hit 15,000 to 40,000 transactions per second. Compare that to Ethereum mainnet’s roughly 15-30 TPS. The difference is three orders of magnitude.

Fees tell an even more dramatic story. A simple transfer on Arbitrum costs around $0.0001. The same transfer on Ethereum mainnet, even with recent improvements, runs $1-5 depending on network congestion. For DeFi transactions—swaps, lending, borrowing—savings are even more pronounced. What cost $50-200 on mainnet costs pennies on L2.

These aren’t theoretical numbers. Total value locked across L2 networks exceeded $40 billion by late 2025. Daily transaction volumes regularly surpass Ethereum mainnet by 5-10x. The shift in user behavior is equally telling: most new DeFi users never interact with mainnet directly. They arrive through Base, Arbitrum, or Optimism and never look back.

How Rollups Work: The Short Version

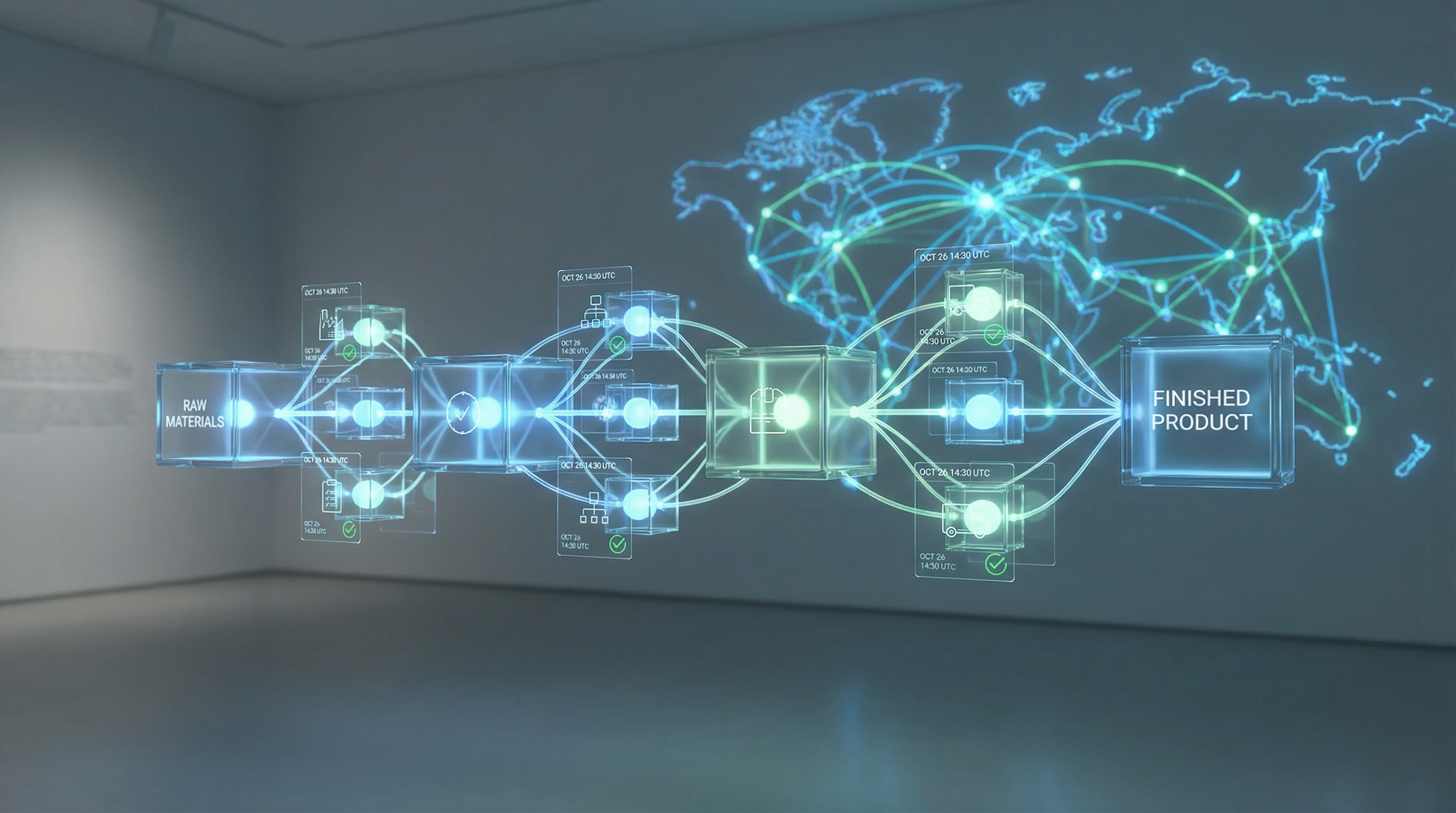

Understanding why rollups succeeded requires minimal technical background. Think of Ethereum mainnet as a prestigious but expensive university. It verifies everything rigorously, maintains perfect records, but charges high tuition.

A rollup is like that university opening satellite campuses. The satellite handles the day-to-day work—student lectures, homework, exams. It batches thousands of transactions together, compresses them, and sends a summary to the main university for final verification.

This “summary” is where the magic happens. Instead of verifying each transaction individually, Ethereum verifies a single cryptographic proof that attests to the entire batch’s validity. The security guarantees remain essentially equivalent to mainnet, but the throughput increases by orders of magnitude.

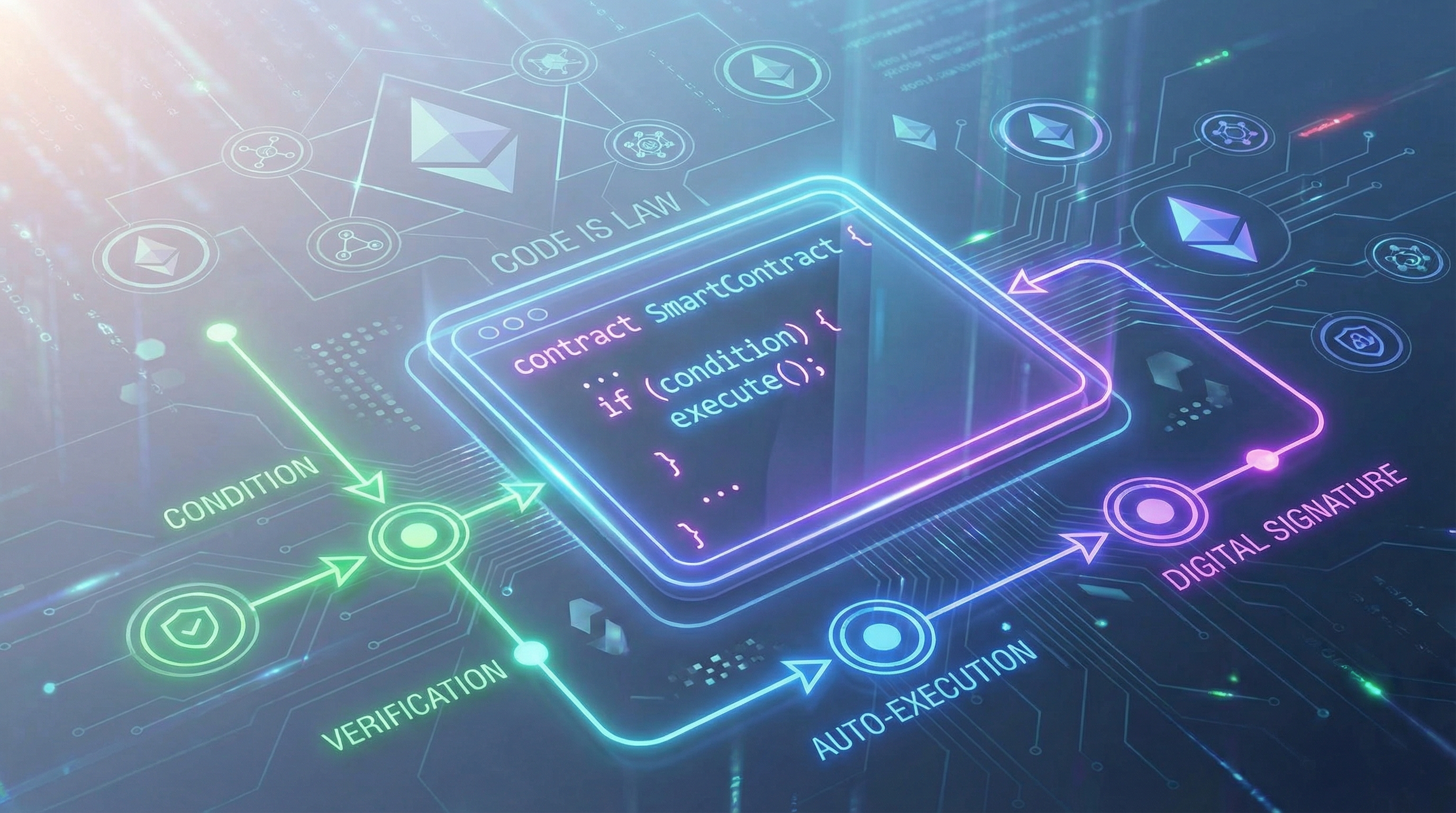

There are two varieties, and both have found their place. Optimistic rollups assume transactions are valid by default and only verify if someone challenges them. This approach is simpler and faster for most use cases. ZK rollups prove validity mathematically for every batch, offering stronger guarantees but with more computational overhead.

By 2026, the debate between the two has cooled. Both approaches work. Users rarely care about the distinction. What matters is speed, cost, and security—and both deliver.

The Infrastructure Layer Matures

Rollups in 2026 look nothing like the experimental projects of 2023. The infrastructure has matured dramatically.

Cross-chain bridges have improved substantially. Early L2 adoption was hamstrung by slow, expensive, risky bridges. Moving assets between rollups meant going back to Ethereum mainnet, paying $20-50 in gas, and waiting for confirmations. Today’s bridges move value directly between L2s in seconds for fractions of a cent.

Wallet experience has normalized. In 2023, using an L2 required explaining bridging, gas tokens, and RPC configuration to users. Now Coinbase Wallet, MetaMask, and Rainbow handle L2s natively. Users don’t know they’re on Layer 2 and shouldn’t need to care.

Developer tooling has caught up. Hardhat and Foundry support L2 deployment natively. Chainlink, The Graph, and other major infrastructure providers serve L2 endpoints with feature parity to mainnet. The developer experience gap has effectively closed.

Perhaps most importantly, the rollup ecosystem has consolidated around a few dominant players. The “rollup season” of 2024, when dozens of projects announced their own L2s, has given way to market reality. Base, Arbitrum, and Optimism dominate transaction volume. zkSync and Starknet serve specific use cases. Most aspiring rollup projects have pivoted or faded.

Where Things Still Break

Hype would suggest rollups have solved everything. They haven’t.

Centralization remains the elephant in the room. Most rollups operate centralized sequencers—servers that order transactions before submitting them to Ethereum. This creates a single point of failure and gives operators significant power over transaction ordering. MEV extraction, transaction censorship, and potential regulatory pressure all flow from this architectural reality.

The roadmap to decentralized sequencing is clear but unproven. Projects like Espresso, Shared Sequencer, and EigenLayer’s approach offer paths forward. Some rollups have begun transitioning to decentralized sequencer sets. But as of early 2026, no major L2 has fully decentralized production sequencing.

Data availability presents another challenge. Rollups post transaction data to Ethereum as “blobs”—efficiently encoded batches that secure the chain’s history. This works today but scales awkwardly. As transaction volumes grow, the data availability layer will need further evolution. Celestia and EigenDA offer alternatives, but adoption remains early.

Interoperability between rollups, while improved, still falls short of the vision. True “chain abstraction”—where users and developers treat all L2s as a single execution environment—remains aspirational. Asset movement is fast, but state sharing, cross-chain composability, and unified liquidity remain challenging.

Institutional Adoption Arrives

The most significant shift in 2025-2026 isn’t technical. It’s institutional.

Major financial institutions that experimented with blockchain have mostly settled on L2 infrastructure. JPMorgan’s Onyx, Goldman Sachs’ tokenization platform, and BlackRock’s fund tokenization initiatives all run on Ethereum L2s. The rationale is straightforward: they need Ethereum’s security and ecosystem, but can’t justify mainnet costs for high-volume operations.

This institutional migration brings real money and real credibility. It also brings regulatory attention. As billions in value transit L2s, compliance requirements intensify. Several jurisdictions now require licensed operators for certain L2-based financial products. The regulatory environment is still forming, but the direction is clear: L2s are serious enough to regulate.

Traditional financial institutions have also begun building L2-native products. Lending protocols, payment systems, and asset management tools that would have been impossible on mainnet due to cost now make economic sense. The sub-cent transaction fee enables business models that were previously unviable.

What Comes After Rollups?

The rollup revolution has largely succeeded. The question now becomes: what’s next?

Proto-danksharding, the upgrade that enabled blob transactions, was just the first step. Ethereum’s roadmap includes full danksharding, which will dramatically increase data availability capacity. When combined with advanced data compression techniques, this could push L2 costs even lower—potentially to where transaction fees become effectively negligible for most users.

Layer 3s—rollups built on top of rollups—have emerged for specific use cases. These “validiums” sacrifice some security for extreme performance, serving high-frequency trading, gaming, and other latency-sensitive applications. While unlikely to replace L2s for financial applications, they serve important niches.

The ultimate vision remains chain abstraction: a world where users hold assets that work seamlessly across any L2, where developers deploy code once and it runs everywhere, where the boundaries between chains are invisible to end users. We’re closer than ever, but not there yet.

For Ethereum, the rollup-centric roadmap has vindicated itself. The bet on L2s as the scaling solution, rather than endlessly increasing mainnet capacity, appears to have been correct. The network that was too expensive for ordinary users now serves millions daily with costs they barely notice.

The future of Ethereum is L2. That future is here.