Real World Assets (RWA) Tokenization: Connecting DeFi with Traditional Finance

Real-world assets (RWAs) are being tokenized and brought onto blockchains, creating a connection between decentralized finance (DeFi) and traditional finance (TradFi). This changes how assets can be traded, who can access them, and how quickly transactions settle.

This guide walks through how RWA tokenization works, the process of tokenizing assets step-by-step, and how this technology connects two financial systems that have operated separately until now.

What is RWA Tokenization?

Real-world asset tokenization creates a digital representation of an asset on a blockchain. The digital token reflects the legal rights attached to the underlying asset through a structure like a Special Purpose Vehicle (SPV), trust, or fund vehicle.

Tokenized real-world assets are blockchain-based digital tokens that represent physical and traditional financial assets: cash, commodities, equities, bonds, credit, artwork, real estate, and intellectual property. Tokenization changes how these assets can be accessed, exchanged, and managed.

Unlike crypto-native tokens that exist purely on-chain with no claim on an external asset, RWA tokens represent an interest in a real asset and typically fall within securities classifications because they reflect ownership, economic rights, or claims linked to some financial instrument.

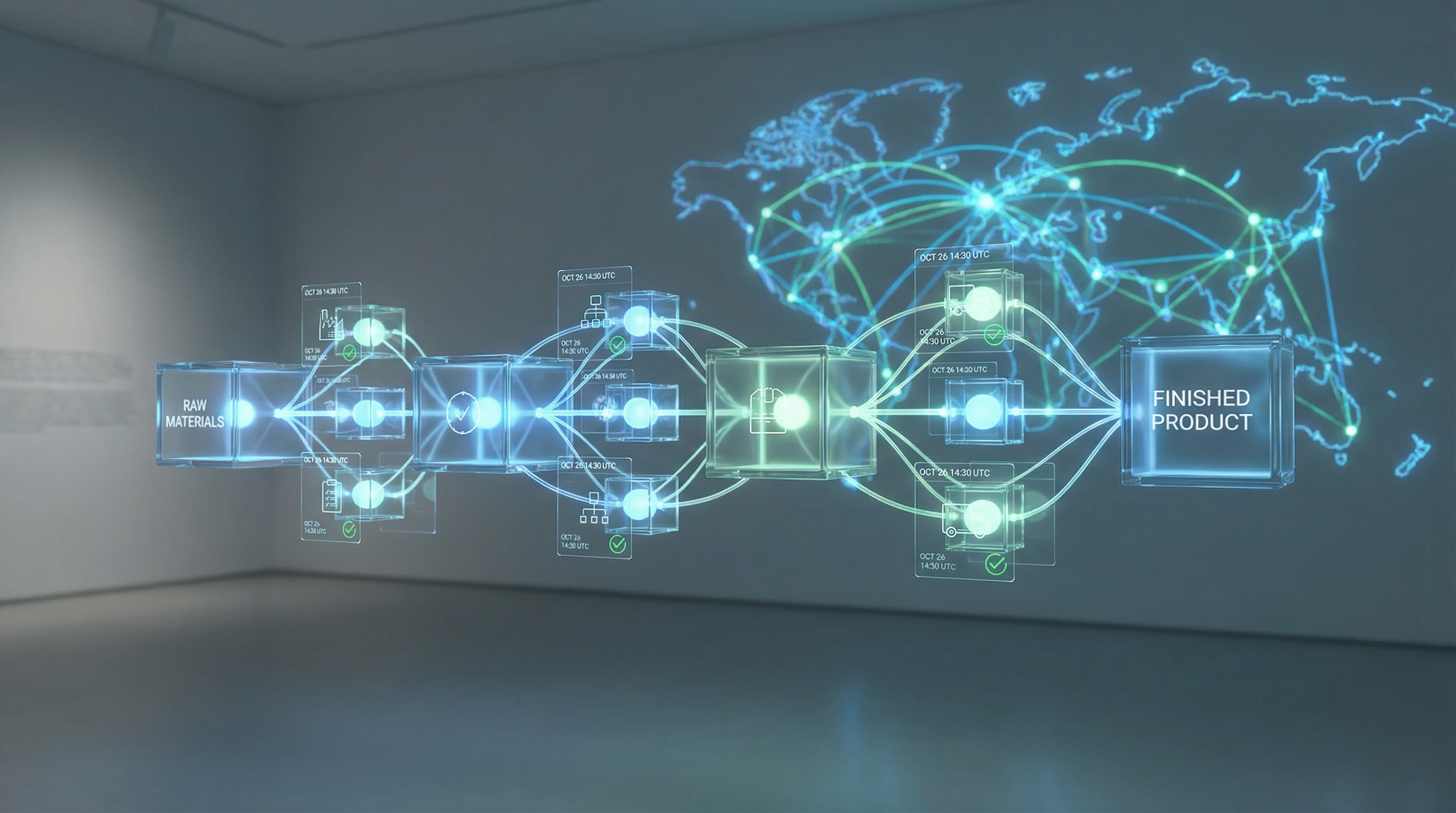

The bridge between DeFi and traditional finance

Real-world assets connect DeFi and TradFi, creating new possibilities for both sectors through better liquidity and efficiency. This addresses a basic problem: while DeFi works well as a technological layer for financial activity, most assets still exist outside the blockchain ecosystem.

Why this matters

Bringing real-world assets into DeFi platforms creates new liquidity opportunities. Investors can trade assets 24/7, participate in fractional ownership, and access global markets with fewer barriers. Smaller investors can now access high-value assets that were previously out of reach.

For DeFi platforms, RWAs mean expanding beyond crypto-native financial products. Tokenized assets in DeFi protocols offer more stable, diversified investment options that are less vulnerable to crypto market volatility. RWAs provide DeFi platforms with reliable collateral, enable more sophisticated lending mechanisms, and connect to traditional financial markets.

Current market landscape

The tokenized RWA market has grown substantially. As of November 2025:

- Private credit: Active on-chain private credit exceeds $18.91 billion, with cumulative originations reaching $33.66 billion

- U.S. Treasury exposure: More than $9 billion in tokenized Treasury value

- Commodities: Total value exceeds $3.5 billion, with gold dominating at over $2.9 billion

- Institutional fund structures: Tokenized fund exposure stands at approximately $2.95 billion

Tokenization is gradually integrating into mainstream financial infrastructure. Projections suggest the market could reach $400 billion in 2026 and potentially $16 trillion by the end of the decade.

Step-by-step guide to RWA tokenization

The tokenization process varies by asset type, jurisdiction, and legal structure, but typically follows these stages:

Step 1: Asset selection and evaluation

Start by identifying an asset suitable for tokenization. This includes:

- Asset identification: Determine which real-world asset to tokenize (real estate, fine arts, commodities, precious metals, bonds, or other financial instruments)

- Eligibility assessment: Ensure the asset is eligible for tokenization and complies with relevant regulations

- Valuation: Assess and document the asset’s value following standard financial practices

- Documentation review: Confirm ownership and review all relevant documentation

Common assets being tokenized today include private credit instruments, U.S. Treasuries, real estate properties, commodities (especially gold), institutional fund structures, and various debt instruments.

Step 2: Legal structuring

Establish a legal framework to ensure digital tokens represent valid claims to the underlying real-world assets. This involves:

Defining token rights: Determine what specific rights the tokens will represent, such as:

- Ownership rights (equity-like tokens)

- Revenue rights (profit-sharing tokens)

- Debt rights (bond-like tokens)

- Usage rights (utility-focused tokens)

Choosing a tokenization structure: Two common approaches include:

-

Tokenized SPV (Special Purpose Vehicle): The asset is held by an entity (private limited company or trust), which is then tokenized. Tokens are issued through pooling funds from multiple investors, giving them indirect interests in the underlying RWA. This approach often fits better within securities regulations.

-

Direct asset tokenization: The asset itself is directly tokenized, and tokens represent a direct claim on the underlying asset. This approach is less common due to regulatory challenges, non-fungibility issues, and limited use cases.

Legal documentation: Prepare documents that define rights, obligations, and how the token represents the asset, ensuring compliance with securities laws and investor protection requirements.

Step 3: Custody arrangements

Before digitalization, establish custody arrangements for both the underlying asset and the digital tokens:

RWA custody: The underlying physical or traditional asset must be custodized to ensure it is immobilized and safely kept before its digital representation is created on the blockchain. For tangible movable assets like commodities, the RWA is securely stored and managed by qualified custodians, trustees, or licensed managers.

Token custody: Digital tokens can be held through:

-

Self-custody: Users maintain full control over their private keys through software-based (mobile/desktop applications) or hardware-based (physical devices) wallets. While offering better security and privacy, this requires vigilance in safeguarding private keys and recovery phrases.

-

Licensed third-party custodians: Regulated custodians provide professional custody services with stringent security measures, including decentralized security protocols, multi-party computation (MPC), multi-signature wallets, hardware security modules (HSMs), and key sharding. These custodians also ensure compliance with KYC and AML regulations.

Step 4: Blockchain selection and token specifications

Choose the appropriate blockchain infrastructure for your tokenized asset:

Blockchain platform selection: Consider factors such as:

- Public vs. private blockchain networks

- Transaction speed and scalability

- Security features and track record

- Regulatory compliance capabilities

- Interoperability with other networks

Popular platforms for RWA tokenization include Ethereum, Polymesh, and various enterprise blockchain solutions.

Token specifications: Determine:

- Token type (fungible or non-fungible)

- Token standard (ERC-20, ERC-721, etc.)

- Supply mechanics and distribution model

- Transfer restrictions and compliance rules

Step 5: Smart contract development and deployment

Develop and deploy the smart contracts that will govern your tokenized asset:

Smart contract features: Include functionality for:

- Automated compliance checks (investor eligibility, jurisdiction limits, holding periods)

- Transfer restrictions and whitelisting

- Corporate actions (dividends, interest payments, voting rights)

- Redemption mechanisms

- Reporting and audit trails

Security measures: Implement robust security protocols including:

- Multi-signature requirements

- Regular security audits

- Bug bounty programs

- Emergency pause mechanisms

Step 6: Token issuance and primary offering

Create the tokens on a regulated platform and launch the primary offering:

Investor onboarding: Implement comprehensive KYC, AML, and suitability checks through the onboarding workflow. Only approved and whitelisted investors can participate in the offering.

Primary distribution: Launch the offering through:

- The issuer’s website with integrated compliance workflows

- Licensed tokenization platforms (such as InvestaX, Tokeny, or similar regulated marketplaces)

- Institutional distribution channels

Subscription process: Manage the subscription flow, compliance checks, and allocation records. Once subscriptions are approved, allocations are recorded on-chain, creating a synchronized ownership register within the permitted investor base.

Step 7: Secondary trading infrastructure

Where permitted by regulations, establish secondary trading capabilities:

Trading venues: Tokenized RWAs can trade through:

- Peer-to-peer trades on licensed broker-dealer platforms

- Licensed RWA exchanges

- Decentralized exchanges (DEX) with compliance layers

- Automated Market Maker (AMM) protocols designed for security tokens

Compliance controls: Ensure every transfer remains compliant through:

- Smart contract-enforced transfer restrictions

- Real-time compliance verification

- Jurisdictional filters

- Investor eligibility checks

Liquidity considerations: Tokenization improves how assets are serviced and recorded, but it doesn’t automatically transform the economic fundamentals. Building genuine liquidity requires investor demand, market-making support, and appropriate pricing mechanisms.

Step 8: Ongoing management and servicing

Post-tokenization management involves essential services throughout the token’s lifespan:

Asset servicing: Handle:

- Regular asset valuation updates

- Dividend and interest distributions

- Corporate actions (voting rights, redemptions)

- Financial reporting and disclosures

Compliance maintenance: Ensure continued adherence to regulatory requirements through:

- Monitoring changes in securities laws

- Implementing necessary smart contract updates

- Conducting periodic audits

- Managing investor relations and communications

Registry management: Maintain accurate ownership records, process transfers, and ensure synchronization between on-chain and off-chain systems.

Types of assets being tokenized

The RWA tokenization market includes a diverse range of asset classes, each with unique characteristics and use cases:

Private credit and debt instruments

Private credit is the largest category in the tokenized RWA market, with active on-chain private credit exceeding $18.91 billion. Issuers structure senior secured loans, SME financing, and receivables into tokenized formats, typically offering yields in the 8-12% range on the borrower side.

U.S. Treasury and money market products

Tokenized short-duration U.S. Treasury products have become a consistent part of the RWA landscape. They are blockchain-native equivalents to traditional money market strategies. Notable examples include BlackRock’s BUIDL fund (over $2.3 billion in tokenized value) and various tokenized Treasury products from providers like Ondo Finance and Matrixdock.

Real estate

Real estate tokenization enables fractional ownership of properties. Investors can own portions of high-value properties with lower capital requirements. This approach streamlines transactions, reduces paperwork, and eliminates traditional barriers such as lengthy background checks and multiple intermediaries.

Commodities

Tokenized commodities, particularly gold, form an established segment with over $3.5 billion in total value. Gold tokens like PAXG and XAUT account for over 80% of tokenized commodity activity. They provide digital representations of physical holdings while maintaining traditional custody arrangements.

Institutional fund structures

Tokenized institutional investment vehicles bring familiar fund strategies onto digital infrastructure while maintaining established regulatory frameworks. Examples include money market funds, credit products, and alternative investment strategies structured as Variable Capital Companies (VCCs) or similar vehicles.

Benefits of RWA tokenization

Asset tokenization introduces a modern infrastructure for representing, transferring, and servicing assets. Here are the main advantages:

Better accessibility and fractional ownership

Tokenization allows assets to be divided into smaller units, lowering minimum investment sizes and making certain asset classes easier to access. Individuals can hold a portion of an asset while maintaining the same legal protections that apply to the full instrument.

Better liquidity

Tokenized RWAs can increase market liquidity for traditionally illiquid assets. Investors can trade assets 24/7, access global markets, and benefit from more efficient price discovery mechanisms.

Streamlined operations

Traditional issuance and servicing often move across several systems for onboarding, compliance, registry updates, and reporting. Tokenization coordinates these steps within a single environment, reducing administrative effort and supporting more consistent record-keeping.

Faster settlement

Settlement in traditional markets can involve multiple intermediaries and reconciliation processes, resulting in delays. When asset ownership updates occur directly on a distributed ledger, transfers move more quickly and with fewer intermediaries. This is particularly helpful in cross-border transactions.

Greater transparency

A distributed ledger acts as a shared record of ownership and transaction history. Each update is time-stamped and traceable, supporting auditability and regulatory review. This transparency reduces information gaps between issuers, investors, and service providers.

Cost efficiency

By reducing the need for intermediaries and automating many processes through smart contracts, tokenization can lower transaction costs and administrative overhead.

Challenges and risks

RWA tokenization offers benefits, but it also presents several challenges:

Legal and regulatory complexity

One of the main challenges is determining how existing securities laws apply to digital representations of real-world assets. Legal rights attached to tokens must be clearly defined, especially regarding ownership, transferability, and investor protections. Regulatory models differ across regions, requiring issuers and investors to navigate varying rules on custody, investor rights, disclosures, and transfer restrictions.

Technology and operational considerations

Tokenized markets introduce technology-related considerations such as smart contract vulnerabilities, cyber risks, and the need for secure key management. Many fund administrators, custodians, and distributors can’t yet process tokenized transactions seamlessly within existing infrastructure, creating integration challenges.

Liquidity limitations

Despite the potential for improved liquidity, many tokenized instruments currently show low secondary-market depth and trading volumes. Tokenization improves how assets are serviced and recorded, but it doesn’t automatically transform the economic fundamentals or create investor demand.

Custody and safekeeping uncertainties

Traditional custodians are still building capabilities to support digital wallets, smart contract governance, and interoperability with tokenization platforms. Investors want clarity on whether tokenized assets are recognized as property, how custody rights are preserved in insolvency, and how reconciliation is performed across on-chain and off-chain systems.

Market fragmentation

The tokenization ecosystem is fragmented across different blockchain platforms, standards, and regulatory jurisdictions, creating interoperability challenges and limiting network effects.

Real-world examples and use cases

Several projects demonstrate the practical application of RWA tokenization:

BlackRock BUIDL

The USD Institutional Digital Liquidity Fund is a tokenized cash-management fund launched on Ethereum, offering exposure to short-duration U.S. Treasuries. With over $2.3 billion in tokenized value as of December 2025, it is the largest institutional tokenized fund by assets under management.

Franklin OnChain U.S. Dollar money market fund

Structured as a sub-fund under Singapore’s Variable Capital Company (VCC) framework, this tokenized money market fund provides access to stable income through a portfolio of high-quality, short-term debt and money market instruments.

Real estate tokenization platforms

Platforms like RealT focus on tokenizing U.S. real estate. Multiple investors can own fractions of properties and receive proportional rental income, demonstrating how tokenization can make real estate investment more accessible.

Commodity tokenization

Gold tokenization through products like PAXG and XAUT simplifies trading and ownership of precious metals. These products allow for more flexible ownership structures and easier transfer of value.

What’s next for RWA tokenization

Several trends are shaping how RWA tokenization evolves:

Increased institutional adoption

Major financial institutions are exploring tokenization to improve liquidity and efficiency. As more banks and asset managers get comfortable with blockchain infrastructure, expect deeper integration with traditional finance systems.

Regulatory evolution

As tokenization gains traction, regulations will continue to adapt and provide clearer guidelines. This regulatory clarity will boost investor confidence and enable broader adoption of tokenized assets.

Technological advancements

Improvements in blockchain technology—including better scalability, interoperability solutions, and more sophisticated smart contract capabilities—will make tokenization viable for a broader range of assets.

Expansion of asset classes

The range of tokenized assets will continue to expand beyond current categories to include more diverse financial instruments, intellectual property, carbon credits, and other asset types.

Integration with DeFi protocols

As the connection between TradFi and DeFi strengthens, expect to see more integration of tokenized RWAs with DeFi lending protocols, yield farming strategies, and other decentralized financial products.

Conclusion

Real-world asset tokenization changes how we think about asset ownership, investment, and financial infrastructure. By connecting DeFi and traditional finance, RWA tokenization makes investment opportunities more accessible, improves liquidity for traditionally illiquid assets, and creates a more efficient and transparent financial system.

The process of tokenizing real-world assets—from initial asset selection through ongoing management—requires attention to legal structuring, custody arrangements, regulatory compliance, and technological infrastructure. Challenges remain around regulatory clarity, liquidity development, and technological integration, but tokenization is becoming part of mainstream financial infrastructure.

For investors, institutions, and entrepreneurs looking to participate in this shift, understanding the fundamentals of RWA tokenization matters. As the market matures, those who understand both the opportunities and challenges of this technology will be positioned to benefit from the convergence of traditional and decentralized finance.

Finance is moving onchain. RWA tokenization is the connection that will bring trillions of dollars of real-world value into the blockchain ecosystem.